Fortitude Budget

Fortitude Budget

Announced by Mr Heng Swee Keat, Deputy Prime Minister and Finance Minister, in Parliament on 26 May 2020. This supplementary budget draws a further S$31 billion from past reserves for Singapore’s fourth budget this year 2020 to further support firms, save jobs and create jobs.

What you need to know about this fourth supplementary budget for your business? We provide you with a quick view summary as follow:

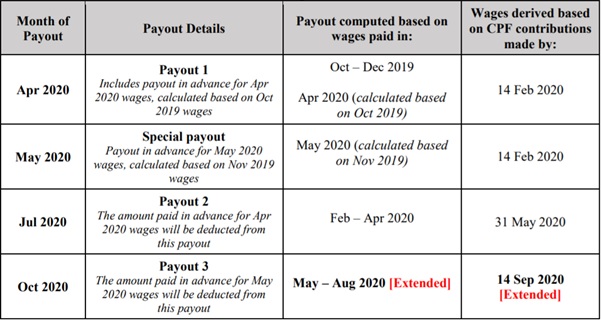

Extension of JSS to cover wages paid in August 2020

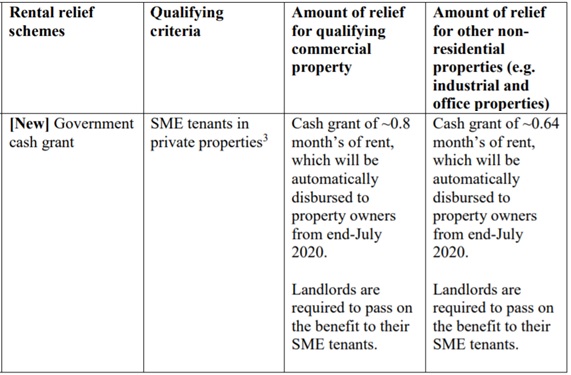

Rental Relief for SME Tenants in Private Non-Residential Properties

The new government cash grant will be disbursed automatically by IRAS to the qualifying property owners. The amount of grant will be calculated based on the Annual Values of properties for 2020, as determined by IRAS at 13 April 2020.

For property owners whose properties are only partially let out, or whose properties are let out to both SME and non-SME tenants under a single property tax account, they will not automatically receive the government cash grant. In such instances, the property owner should submit an application to IRAS, and provide supporting documents, including proof of SME tenants within its property. IRAS will pro-rate the government cash grant accordingly.

IRAS will provide more details of the new cash grant on its website by end-June 2020.

Rental Relief for Tenants in Public Properties

Public properties are those Government-owned/managed non-residential properties.

a) Stallholders in Hawker Centres and Markets.

Stallholders who earlier qualified for three months’ worth of rental waiver will now get five months’ worth of rental waiver in total (i.e. two additional months), with a minimum waiver of $200 per month.

b) Commercial Tenants.

Commercial tenants who earlier qualified for two months’ worth of rental waiver will now get four months’ worth of rental waiver in total (i.e. two additional months). Eligible tenants/lessees may include those providing commercial accommodation, retail, F&B, recreation, entertainment, healthcare, and other services.

c) Other Non-Residential Tenants.

Other tenants of non-residential premises who earlier qualified for one month’s worth of rental waiver will now get two months’ worth of rental waiver in total (i.e. one additional month). Eligible tenants/lessees may include those in premises used for industrial or agricultural purpose, or as an office, a business or science park, or a petrol station

Boosting e-payment adoption

A bonus of up to $1,500 ($300 per month, over a period of five months) will be given to stallholders in hawker centres (including cooked food and wet market stalls), coffee shops, and industrial canteens to adopt this unified e-payment solution.

The Government will also bear the transaction fees (i.e. merchant discount rate payable by merchants) until 31 December 2023.

For more information about the unified e-payment initiative, please visit: http://www.epaysg.com/

Stallholders who wish to sign-up for the solution can contact NETS at 6274 1212 or email CFCepayments@nets.com.sg.

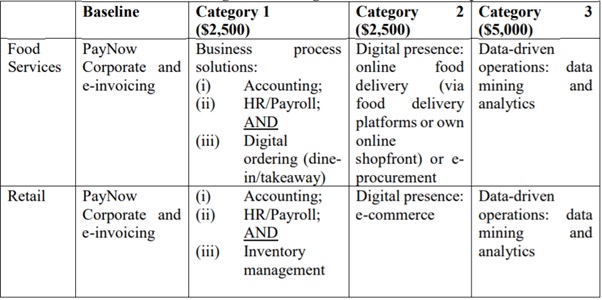

Digital Resilience Bonus

Food Services and Retail enterprises that adopt pre-defined categories of digital solutions can receive bonus payouts of up to $10,000 to offset the cost of adoption. More detail s will be announced at a later date.

Enterprises that adopt qualifying solutions in any one of the three categories, on top of baseline solutions, will receive bonus payouts for the respective categories. For example, an enterprise that adopts baseline, Category 1 and Category 2 solutions, will receive a total bonus payout of $5,000. An enterprise can receive up to $10,000, for adopting solutions across all categories (inclusive of baseline category). More details on qualifying conditions will be announced at a later date.

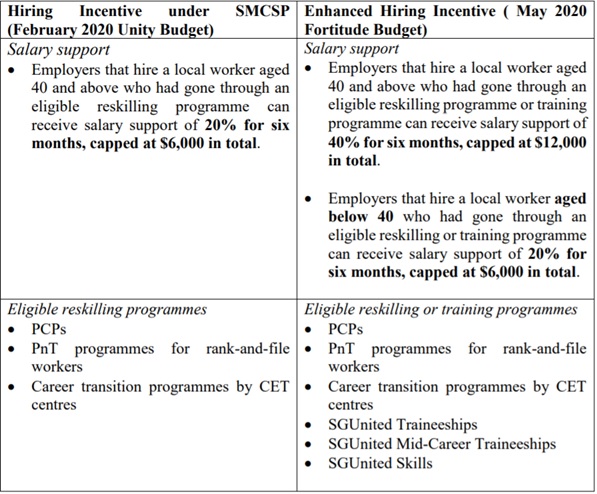

Enhanced Hiring Incentive

The Hiring Incentive was introduced as part of the SkillsFuture Mid-Career Support Package (SMCSP) in the February 2020 Unity Budget, for employers who hire local workers aged 40 and above through eligible reskilling programmes. For each eligible worker hired, the employer would receive 20% salary support for six months, capped at $6,000 in total. Eligible reskilling programmes were the Professional Conversion Programmes (PCPs), Place-and-Train (PnT) programmes for rank-and-file workers, and career transition programmes by Continuing Education and Training (CET) centres.

Given the impact of COVID-19, the Hiring Incentive will be enhanced to cover local workers of all ages, with increased support for those aged 40 and above. We will also expand the list of eligible reskilling and training programmes. The enhanced Hiring Incentive will be applicable to any hire from eligible reskilling programmes from 27 May onwards.

Do feel free to drop us an email if you have query on the above.

Click here for DPM’s full Fortitude Budget Statement.