Standing in solidarity. To get us through the circuit breaker period. Enhance Protection for Jobs & Livelihoods. Strengthen Support for Firms and Worker. Provide More Help to Singaporean

IRAS Extends Tax Filing Deadlines; Taxpayer Counter Services by Appointment Only

Filing deadlines extended for (i) Individual Income Tax, (ii) GST returns for accounting period ending Mar 2020, (iii) Estimated Chargeable Income (ECI) for companies with Financial Year ending Jan 2020, (iv) Income Tax for trusts, clubs and associations

COVID-19 Relief Measures: Upcoming Legislative Provisions To Impose Obligation on Property Owners To Pass On The Property Tax Rebate In Full To Tenants

The Government will introduce new legislation at the next sitting of Parliament

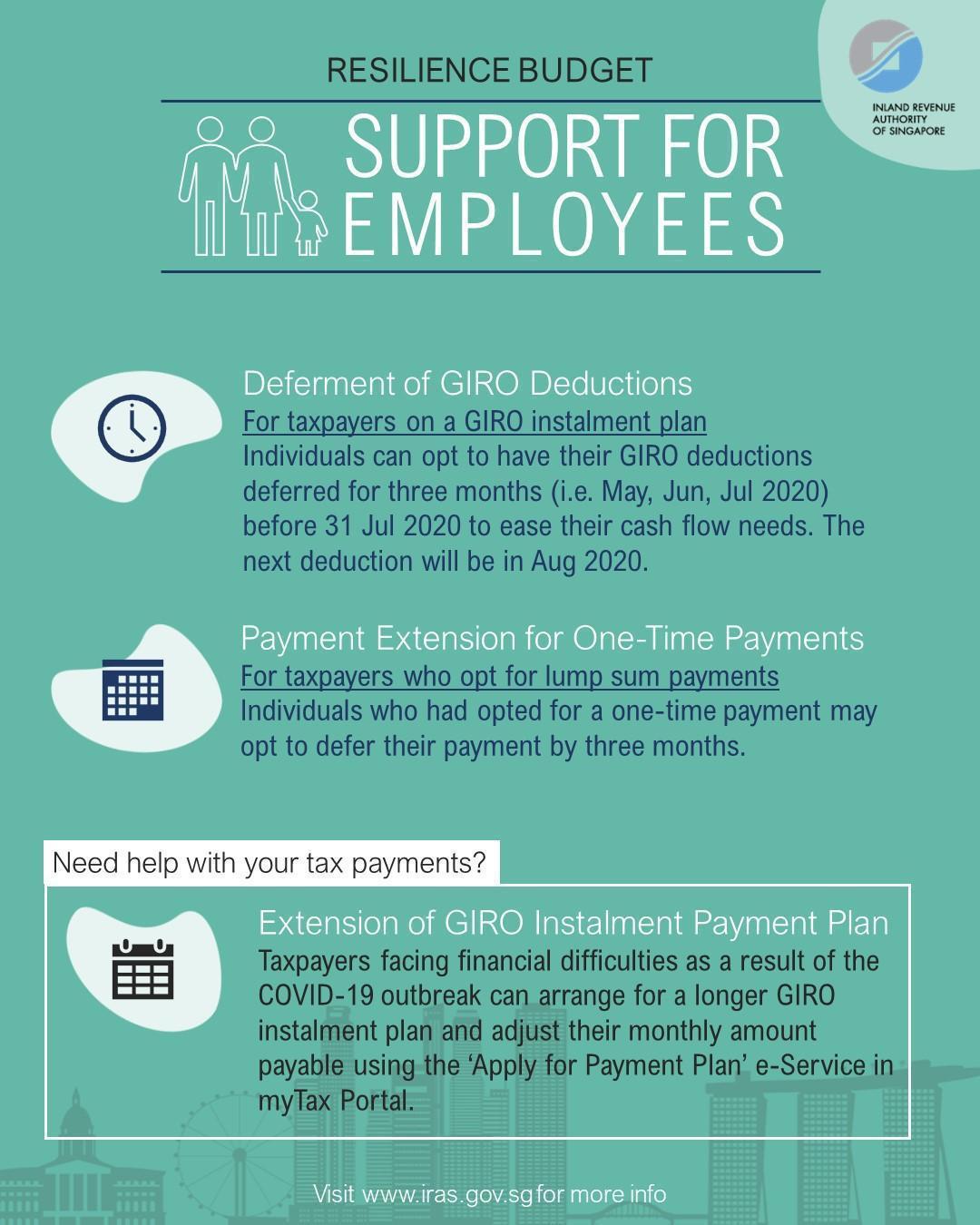

SINGAPORE SUPPLEMENTARY BUDGET 2020 – Support for Employees

Are you an employee having financial difficulty due to the COVID-19 outbreak? Here are the various options that are extended by IRAS to all employees

Supplementary Budget 2020 delivered on 26 March 2020

Support: Our workers and livelihoods. Stabilise: Our economy and businesses. Build: Resilience in our society

SINGAPORE BUDGET 2020

8 things Businesses need to know about Budget 2020:

Are your businesses affected by the recent Coronavirus or COVID-19 outbreak?

GST Hike by 2% Will Not Take Effect in 2021

SME Working Capital Loan

SkillsFuture Enterprise Credit (SFEC)

Wage Credit Scheme (WCS)

Startup SG Equity

Support for Enterprise Growth and Digital Capabilities

Tax Changes for Vehicles

IRAS | Novel Coronavirus – Advisory to Taxpayers

The Inland Revenue Authority of Singapore (IRAS) is stepping up on precautionary measures for the safety and well-being of taxpayers in view of the Novel Coronavirus situation.

- Page 2 of 2

- 1

- 2