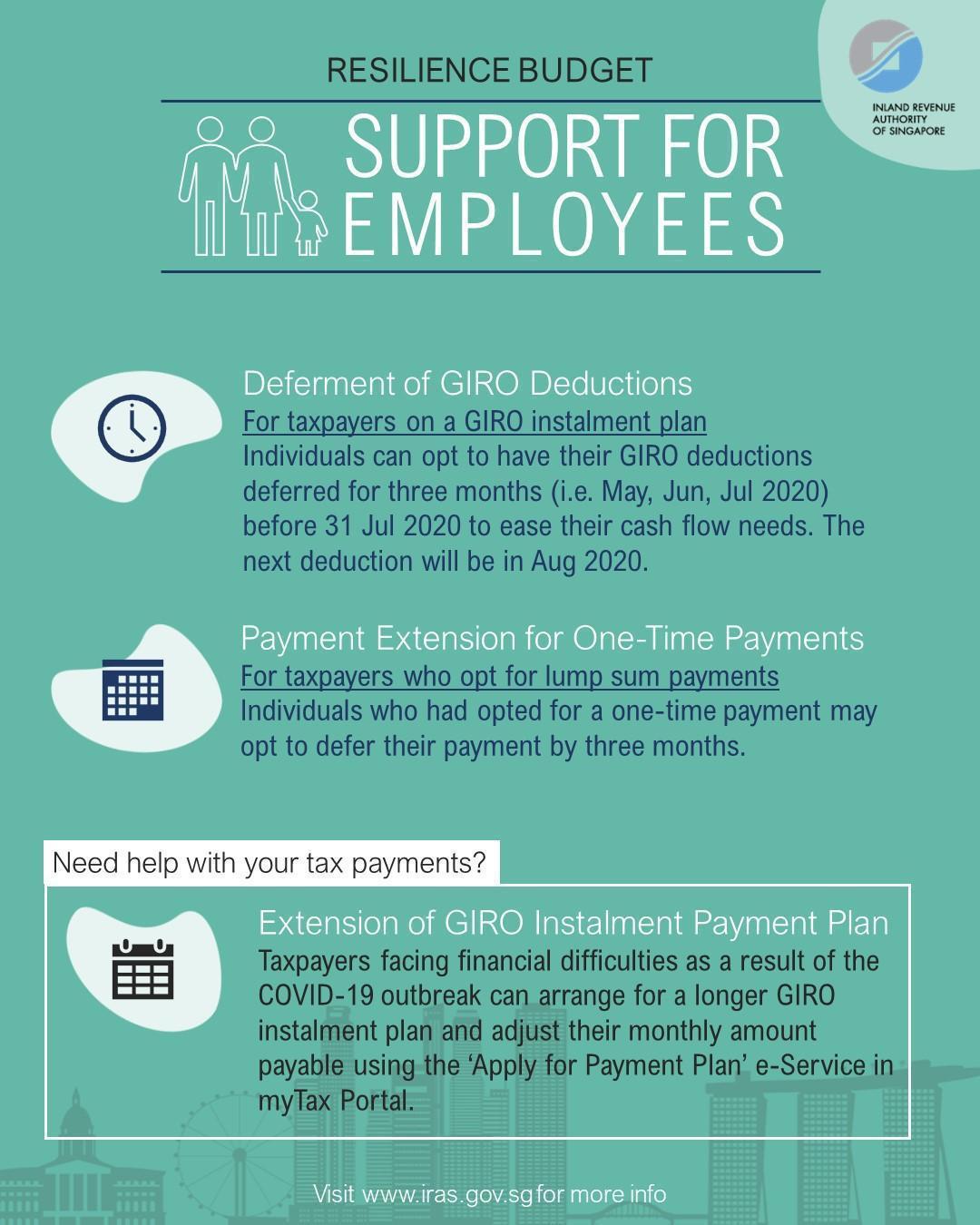

SINGAPORE SUPPLEMENTARY BUDGET 2020 – Support for Employees

Are you an employee having financial difficulty due to the COVID-19 outbreak? Here are the various options that are extended by IRAS to all employees:

- To defer your GIRO income tax payment, sign up for this option whereby no GIRO deductions will be made in May, Jun and July 2020 to help ease your cash flow needs. Your income tax deduction will resume in August, September, or October 2020.

- Currently you do not have a GIRO arrangement with IRAS, you may opt to defer your payment by three months. For instance, if your current tax payment due date is 5 May 2020, you may opt to pay in lump sum by 5 August 2020.

- Need more time to sort out your tax payment? You may arrange for a longer GIRO instalment plan upon receipt of your electronic tax bill (i.e. eNOA).

All the above options extended by IRAS to all employees are not given automatically but rather granted on application and on case-by-case assessment basis.

Please feel free to contact us if you do require help in this matter.